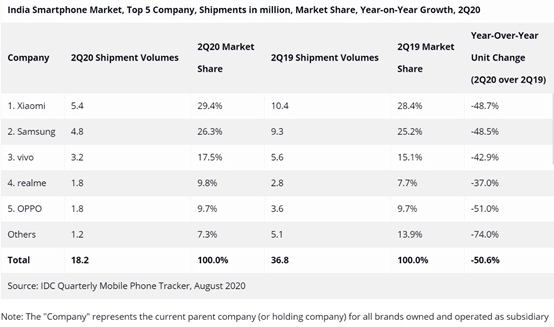

According to data tracked by IDC, the Indian smartphone market in the second quarter fell sharply year-on-year (-50.6%) to 18.2 million units.

The online channel’s market share was as high as 44.8%. But, due to restrictions on electronic product delivery and severe inventory restrictions this quarter, the market share of this channel fell by 39.9% year-on-year.

In the second quarter of 2020, the average selling price of smartphones was US$161. As GST rose in April and the Indian rupee depreciated, various brands were forced to raise prices. Due to low consumer sentiment, the market segment with prices below $200 reached 84%. The market share of segments with prices below $100 has increased to 29% from 20% a year ago. Shipments of high-end (over $500) mobile phones fell 35.4% year-on-year in the second quarter.

Shipments of functional phones in the second quarter fell 69% year-on-year to 10 million units, accounting for 35.5% of the Indian mobile market, the lowest level ever in this segment.

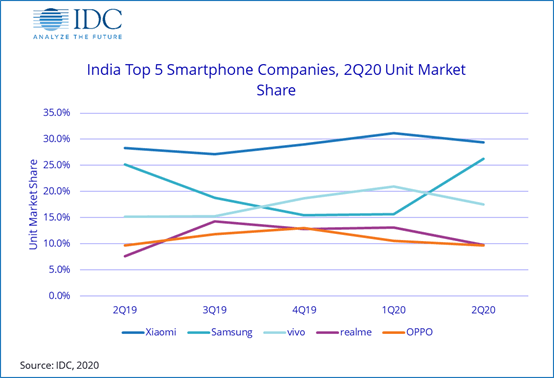

Smartphone vendor rankings

Although MI’s shipments fell by 48.7% year-on-year, it continued to lead with a total shipment of 5.4 million in the second quarter of 2020.

Samsung surpassed Vivo to rank second place, although sales in the second quarter fell sharply year-on-year (-48.5%) to 4.8 million units.

Vivo slipped to third place with 3.2 million units shipped, a 42.9% year-on-year decline in the second quarter.

Realme ranked fourth, with 1.78 million units shipped in the second quarter, a decrease of 37% year-on-year.

OPPO ranked fifth, and its shipments fell 51.0% year-on-year to 1.76 million units in the second quarter of 2020. IDC India Customer Equipment and IPDS Research Director Navkendar Singh said: Continuous supply chain challenges have forced brands to directly import to meet the pent-up demand after the lockdown, especially in June, which adds more cost pressure.”